Vestige Beginners Guide

Learn what Vestige is and how to use it like a pro!

Welcome back to the Club, gov!

It seems like Vestige has been the hottest project on the ecosystem for the past few weeks, and the excitement has reached new heights this week with the release of their DEX aggregator.

In fact, in a recent voting session, Club members voted for our next guide to be the Vestige Beginners Guide. And everyone knows the Club likes to give the people what they want.

In the following guide, we’ll cover what Vestige is, how to navigate its UI, and how to use its charting and swapping features.

To make this guide easier to navigate, we’ve included the table of contents below:

Vestige Overview

Vestige How-To Guide

How to Navigate the UI

How to Chart

How to Swap

Wallet Overview

Okay, let’s dive in.

Vestige Overview

Vestige is an all-in-one trading platform with charting, analytics, and DEX aggregation functionality. Formerly known as TinyChart, it started out as a tool to track ASAs across Algorand with plans to expand their product suite. But due to some miscalculations with their initial tokenomics for their TinyChart Token (TINY), the team couldn’t fund new features and their audits.

Due to this snag, TinyChart rebranded to Vestige and TINY relaunched as VEST with new tokenomics to provide the team with the necessary funding to build out their product suite:

Along with charting and analytics, the Vestige product suite includes three main components:

DEX aggregator: A trading feature that produces an optimized swap across the ecosystem’s DEXs to create efficiencies for traders. Learn more here.

Liquidity & asset locker: Launching later this year, Vestige’s Vault (previously TinySafe) will allow users to create time-locked escrow accounts on chain. This will allow projects to lock up liquidity and provide insurance to investors that they won’t be dumped on or rug pulled.

Staking and launchpad contracts: The Vestige team is also working on staking and launchpad contracts, which will enable other projects to launch their products with access to crowdfunding and token distribution mechanisms without needing to develop them from scratch.

VEST can be used to unlock perks for these features; the more VEST a user holds, the more perks users receive.

Gov Tip: Check out the VEST tiers here.

Vestige How-To Guide

Vestige offers charting, swapping and account tracking capabilities at this time. We’ll review each of those components in the guide below plus how to navigate the UI.

How to Navigate the UI

To get started, navigate to Vestige and select “Connect wallet” in the upper right corner:

Select “Sign transaction” on the prompt to finalize this action.

You can view all assets at once (“Active”) or filter by new, wrapped, or your watchlist by toggling the filters:

You can add an asset to your Watchlist by selecting the star next to the asset’s name:

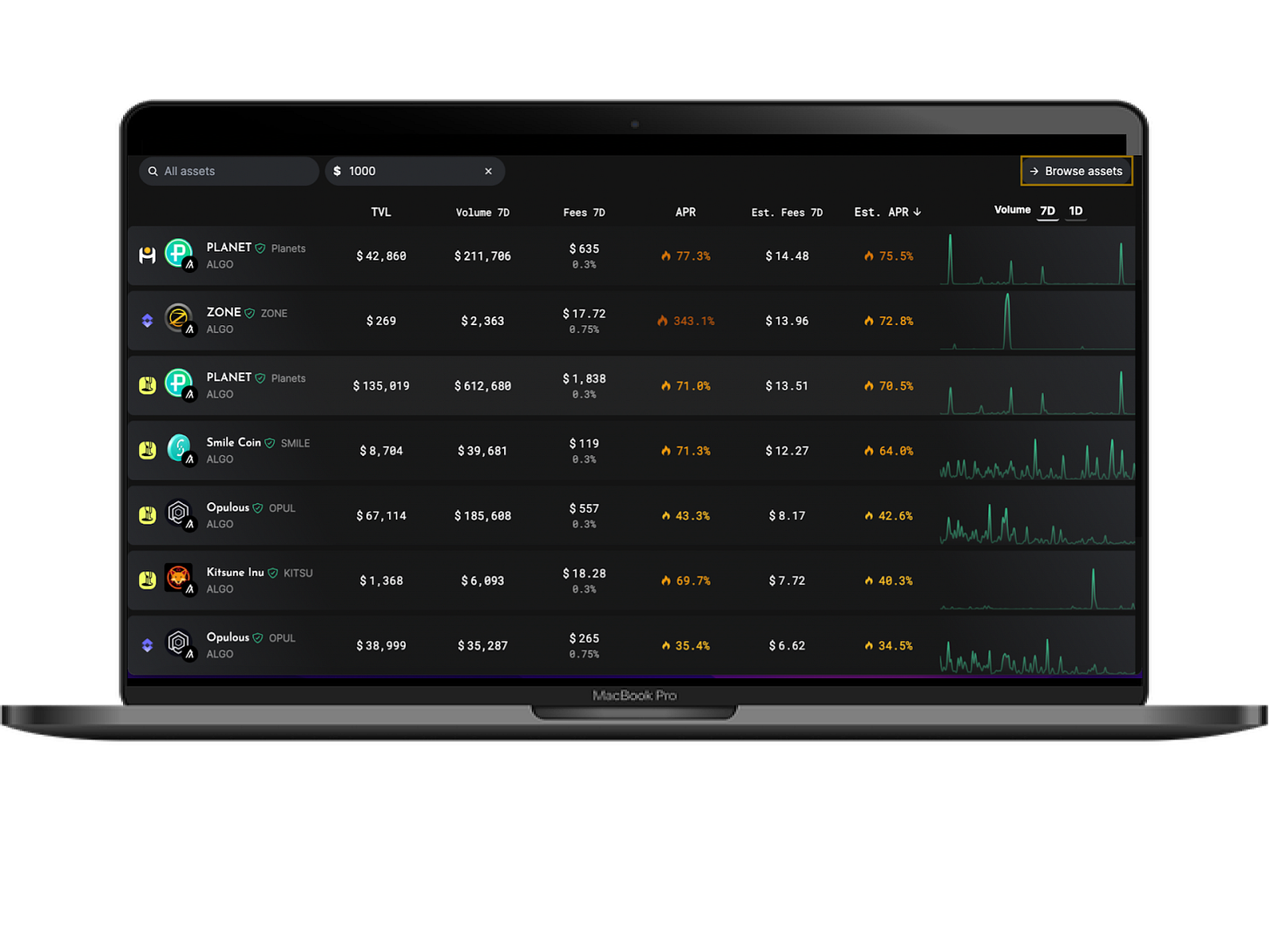

Sort assets by price, percent change (1 hour & 24 hours), TVL (default choice), market cap, and volume by using the menu bar at the top of the asset list:

Use the “7D” and “1D” options to change the timeframe of the displayed chart.

To view the available LPs across the ecosystem, select “Browse pools”:

How to Chart

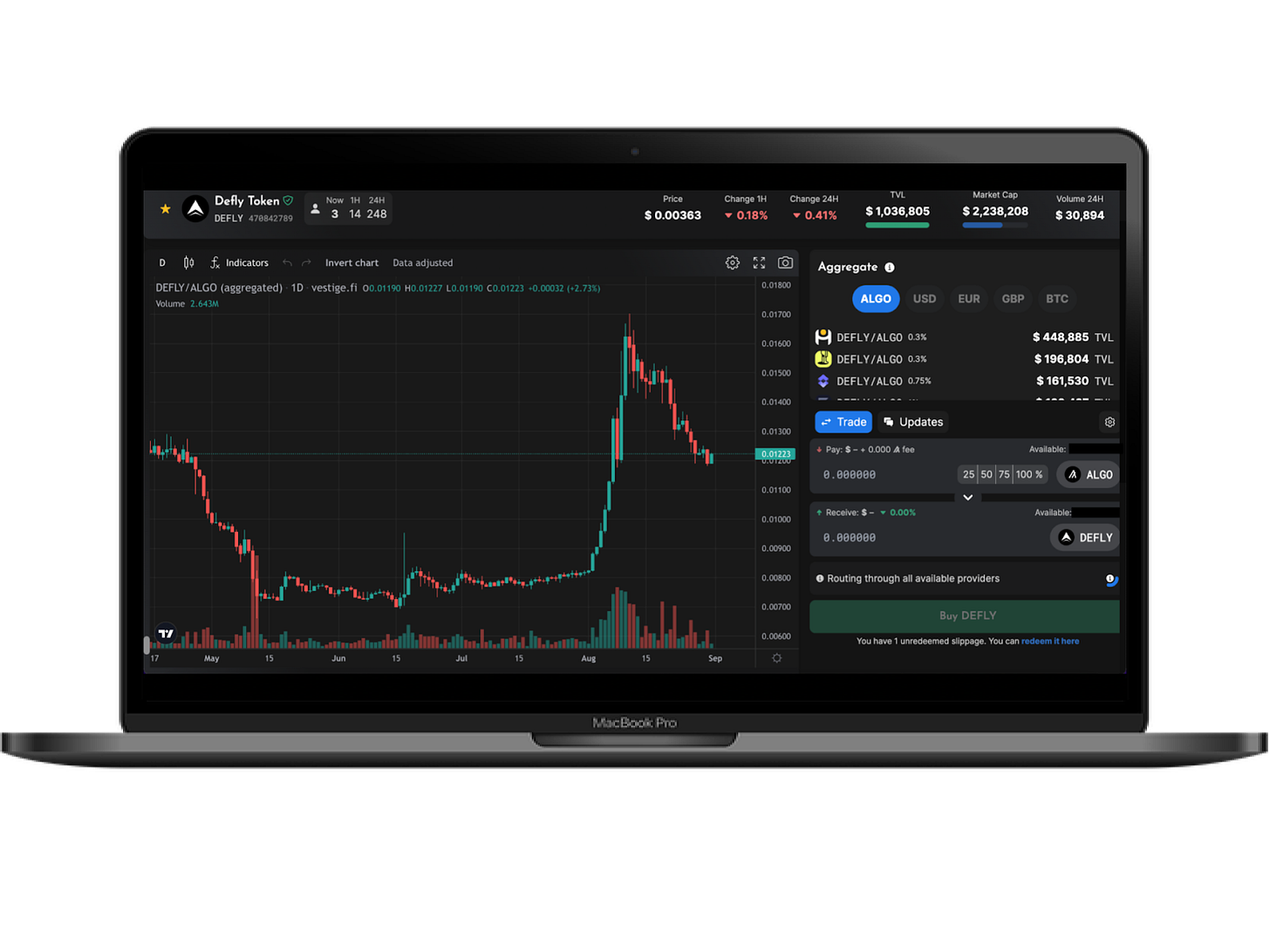

To analyze an asset in more depth, click into it to open up a full view:

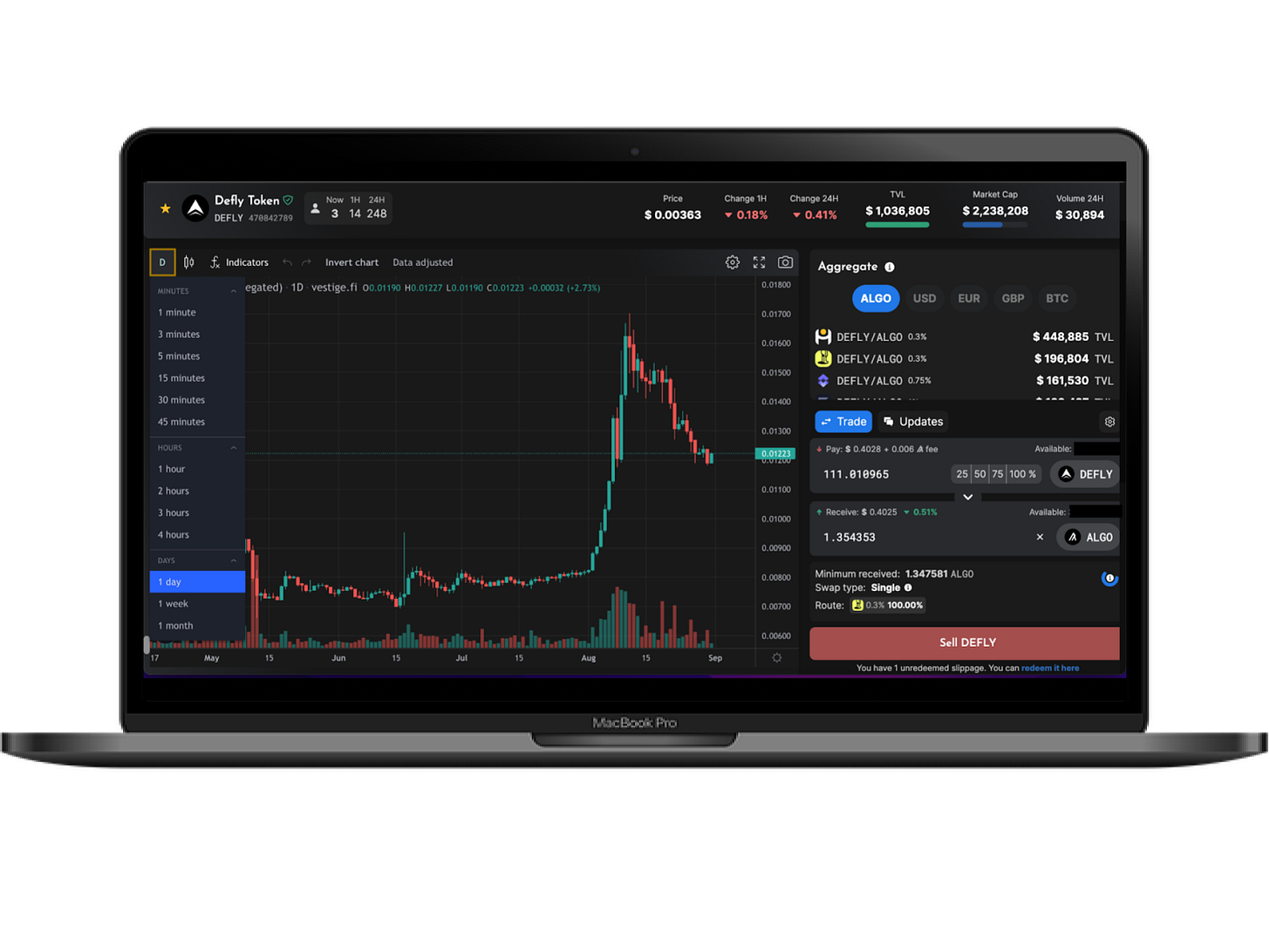

Select your timeframe by selecting “D” from the options at the top:

Change candle types by selecting the candle icon:

Add indicators to the chart by selecting them from the “Indicators” drop down:

Gov Tip: Explaining each of these is outside the scope of this guide, but a few favorites are: Bollinger Bands (provide guidelines on the low and highs of an asset), MACD (identify bullish and bearish momentum to identify entry and exit points), and Relative Strength Index (identify when assets are overbought and oversold).

Select “Invert chart” to get a better sense of the exchange rate between assets (i.e., ~81A = 1 $DEFLY):

Use the arrows to undo or redo an action quickly:

Select the gear icon to change the settings, including the appearance and scale of a chart:

Expand the chart to full screen by using the arrows next to the gear icon:

And use the camera icon to save, copy, or post an image of the chart:

How to Swap

Similar to Defly, Vestige’s DEX aggregation provides both auto-routing and combo swap features. Auto-routing is a trading feature that automatically selects the best price possible by comparing exchange rates across DEXs, while combo swaps aggregate all integrated DEXs together to produce an optimized swap across them. Vestige defaults to the best option for traders.

To begin a swap, input the desired swap amount in the fields on the right side of the screen. Select “Sell [Asset Name]” and sign the transaction with your wallet to finalize the swap:

Due to the low volume of this swap, Vestige defaulted to an auto-route through Tinyman to provide the best possible rate.

You’ll receive a confirmation that your swap was complete and a notification to redeem your excess assets:

Selecting “redeem it here” will take you to the DEX (Tinyman) to redeem your funds:

When swaps are larger in volume, Vestige will default to a combo swap to provide efficiencies across your trade:

Wallet Overview

You can view your assets, portfolio value, and transaction history by selecting your wallet address at the top of the screen:

And now you know how to use Vestige like a pro! If you want to learn more about Vestige, check out their official documentation.

Before you go, we have some exciting news and a quick update. We’re finalizing an Algorand Beginners Guide, which will help onboard new govs to our ecosystem. So you’ll see the next newsletter from us drop in 2 weeks.

See you around the Club, gov.

Disclaimer: This isn’t financial advice! As we say in crypto, don’t trust – VERIFY! Do your own research to determine if Vestige is right for you and don’t ever invest more than you’re willing to lose.

Like any DeFi project, Vestige comes with risks:

Slippage: Slippage occurs when a trade settles for an average price that is different than what was initially requested, and it often happens when there's not enough liquidity to complete your order or the market is volatile. This leads to the final order price changing.

Smart contract failure: By interacting with the protocol, users expose themselves to the risk of smart contract failures / hacks. Despite dApps undergoing rigorous audits, there is always a chance of this in DeFi.

Oracle Risk: In addition to smart contract failures, there is the risk the oracles used by the protocol provide incorrect or stale data.