Humble is a DeFi suite built on Algorand that will offer a wide range of features when fully operational: a DEX, yield farming, liquidity mining, stablecoin pools, derivatives, cross-chain functionality (i.e. cross-chain swaps), customer support help desk, and much more.

Gov Tip: Humble is built on Reach, a blockchain-agnostic programming language.

As of this writing, only the DEX, yield farming, and liquidity mining are available at this time.

But that’s all we need to make some A on Humble.

Getting Started

To get started, select the “Connect Wallet” button in the upper right-hand corner:

How to Swap

After connecting your wallet, navigate to the Swap tab:

Use the drop-down menus to select the two tokens you would like to swap between and then input the amount you want to swap:

Before you finalize the swap, review the risk (price impact & slippage) involved by using the drop-down.

Gov Tip: Review the exchange rate, swap fees, minimum received, and pool liquidity on these screens as well to make sure everything matches your standards.

Finalize the swap by selecting “Swap Tokens” and “Confirm” before signing the transaction with your wallet.

How to Provide Liquidity

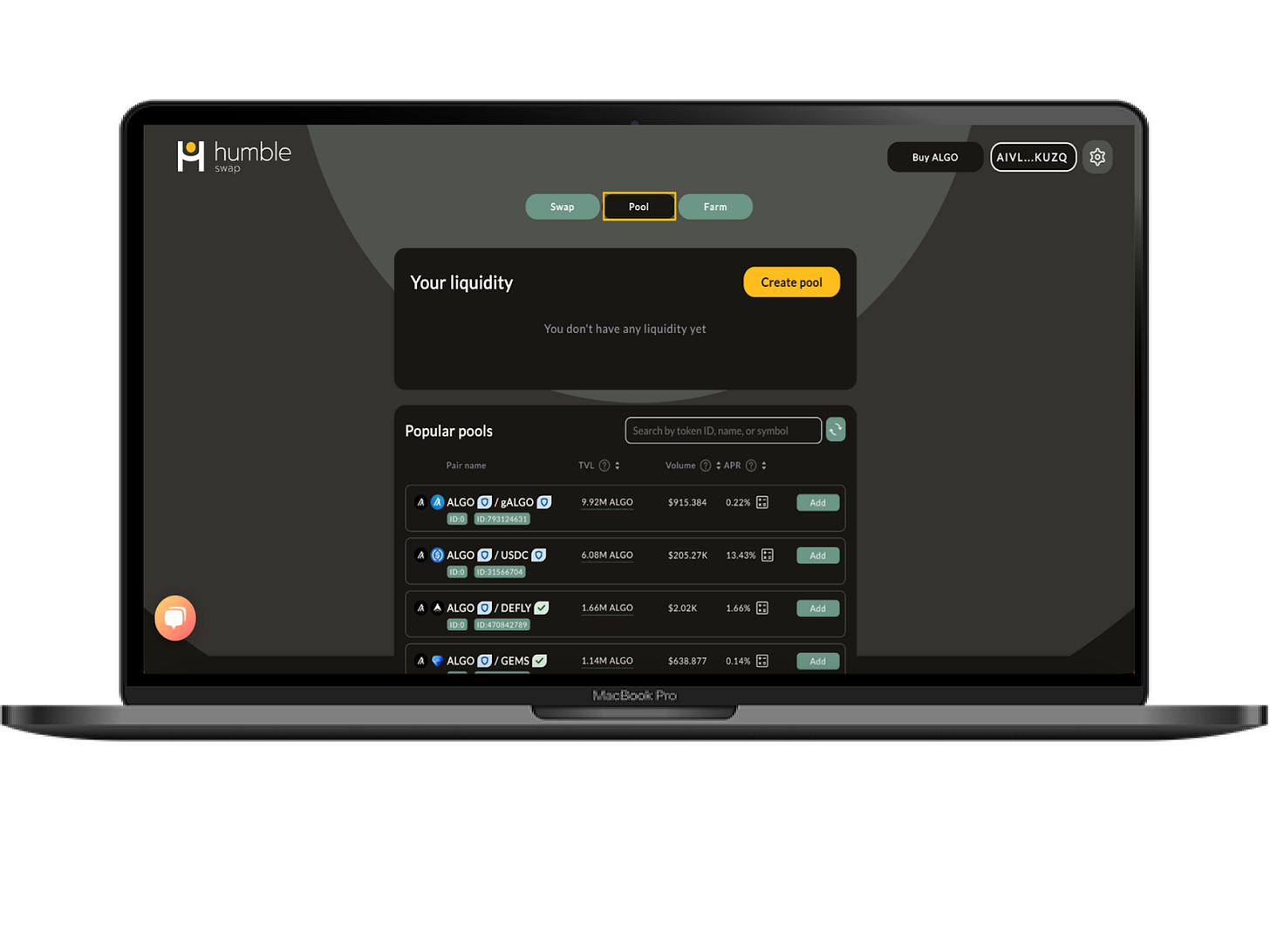

Navigate to the Pool tab to start this process:

Determine the pool you want to provide liquidity to and then select “Add”:

On the following screen, input the amount you want to provide to the pool:

Before you can add liquidity to a pool, you must opt-in to the liquidity pool token (LPT) by selecting that respective button:

Select “Add Liquidity” after you opt-in to the LPT. Finalize the transaction by selecting “Confirm” and signing it with your wallet.

Gov Tip: Remember the amount you supply of each asset needs to be equivalent in value (i.e., 100A = 33 USDC when ALGO’s price is $0.33)

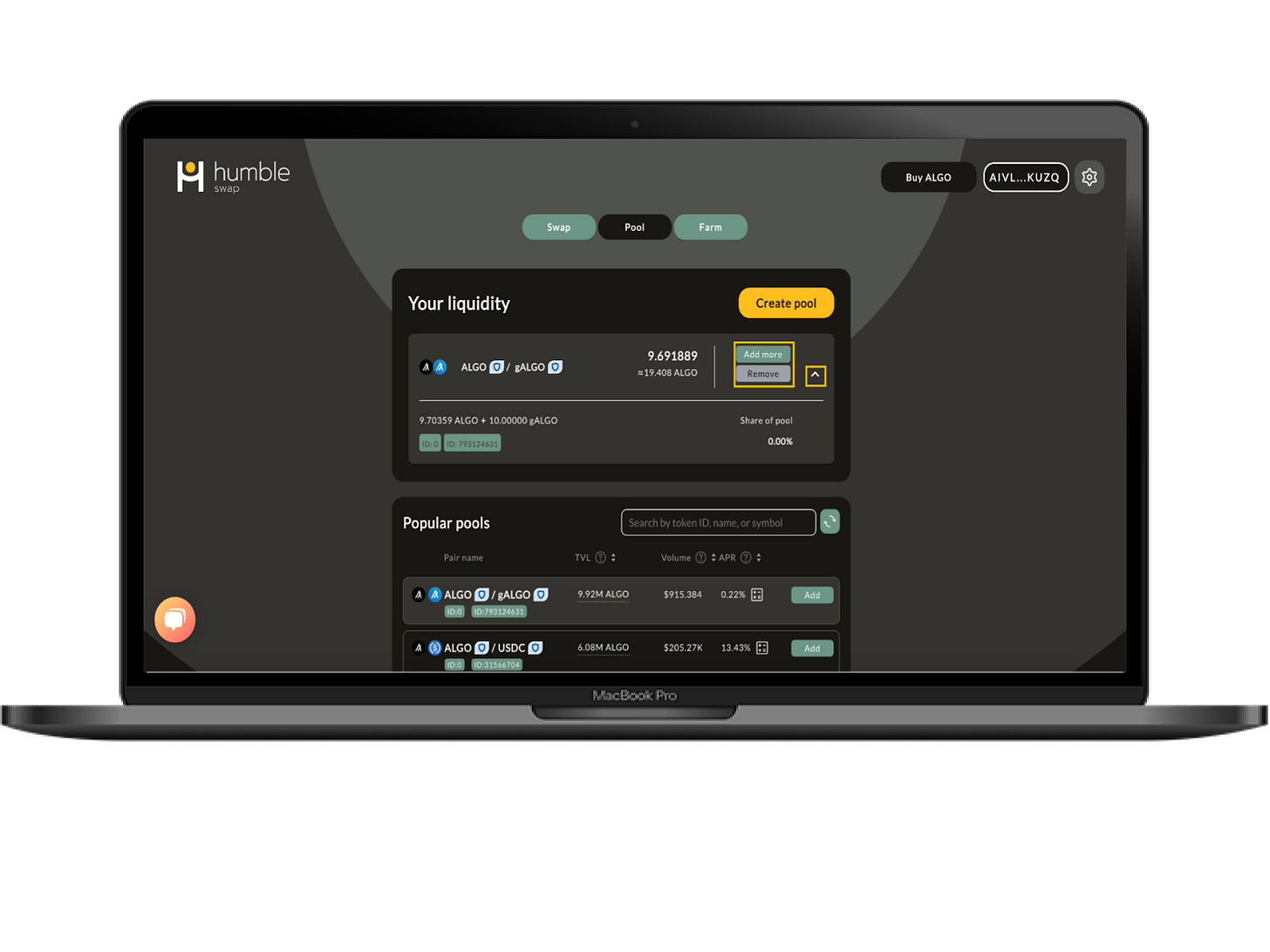

Review your share of the pool and add or remove liquidity by using the “Your Liquidity” menu at the top of the “Pool” screen:

Now that you’re a liquidity provider, it’s time to supercharge your earnings with farming.

How to Farm

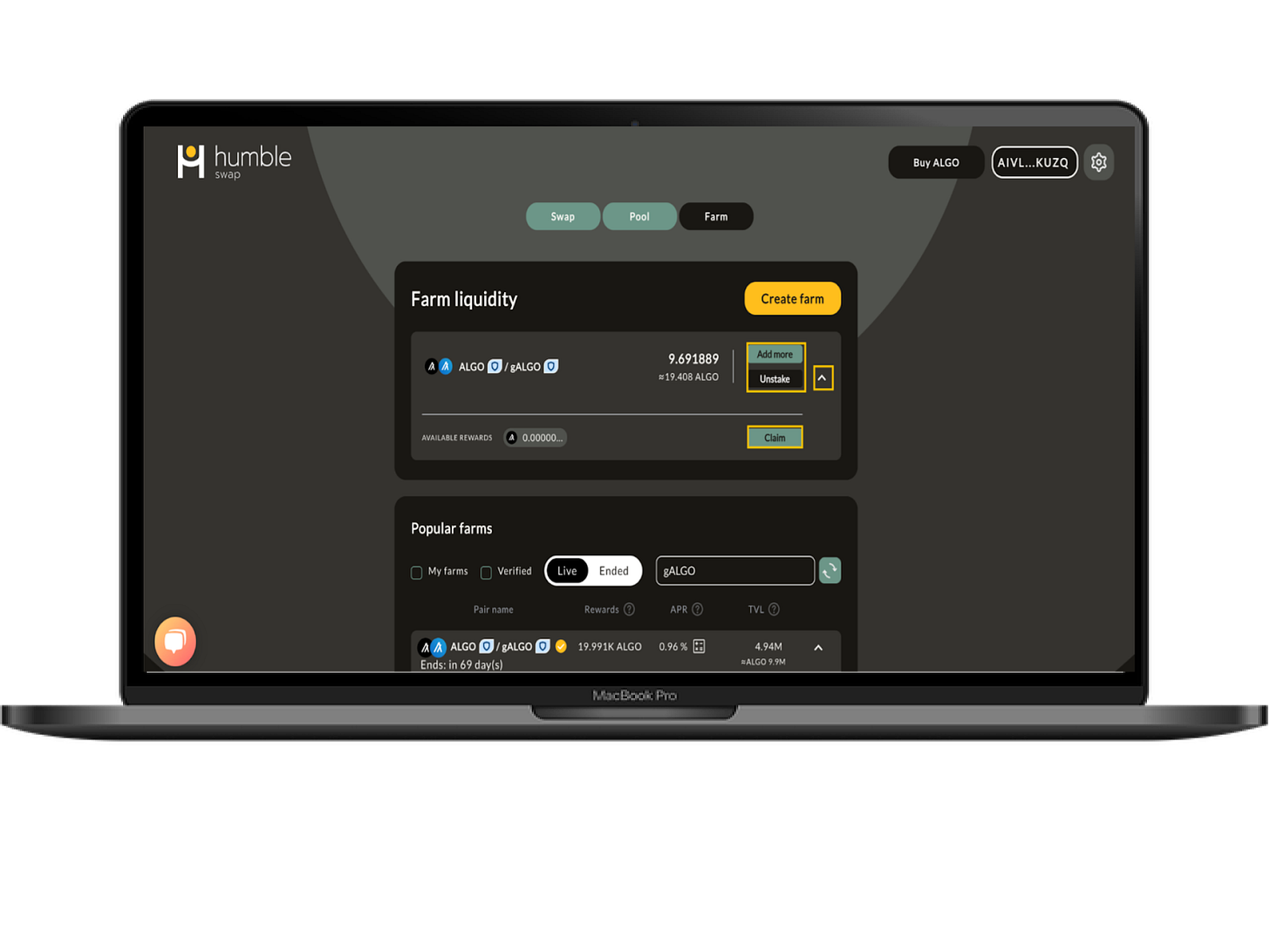

To begin farming your LPTs, navigate to the Farm tab:

Search for the LPTs you want to farm by scrolling through or using the search bar:

Select the LPTs you want to farm by using the drop-down menu and selecting “Stake”.

Input the amount you want to stake or select ‘100%’ to stake all your LPTs and click ‘Stake’ when you’re ready:

Finalize the transaction by signing it with your wallet.

Review the pools you’ve provided liquidity to by checking “Farm Liquidity”’ at the top of the screen:

To claim your rewards or add and remove LPTs, use the drop-down menu and select the respective option.

Gov Tip: Unstaking automatically claims your unclaimed rewards.

Miscellaneous

Select the gear icon in the upper right to open the settings menu:

From here you can switch the protocol to dark mode (pictured above), change the overarching currency unit, and set your slippage tolerance.

You can buy ALGO directly on Humble by selecting “Buy ALGO” at the top of the screen:

Input the amount of ALGO you want to purchase and select the ‘Buy ALGO’ button. Input your payment information to finalize this process.

Gov Tip: Learn more about Wyre here.

And if you ever need help you can select the chat box in the bottom left to talk with live support. How cool is that, gov?

And that’s it, gov! You’re now a Humble pro.

If you want more information on how to use the protocol, we recommend you start with their FAQs.

Disclaimer: This isn’t financial advice! As we say in crypto, don’t trust – VERIFY! Do your own research to determine if Humble is right for you and don’t ever invest more than you’re willing to lose.

Like any DeFi project, Humble comes with risks:

Impermanent Loss: When you provide liquidity to a LP and the price of your deposited assets changes compared to when you deposited them, you can experience impermanent loss. The LP is programmed to maintain a constant value between two tokens, so arbitrage traders will use the pool to swap the two tokens until the necessary constant value is achieved.

This is an important concept to grasp, and we highly recommend you do a deep dive into impermanent loss before becoming a liquidity provider. We recommend this video and article from Binance Academy as a starting point.

Slippage: Slippage occurs when a trade settles for an average price that is different than what was initially requested, and it often happens when there's not enough liquidity to complete your order or the market is volatile. This leads to the final order price changing.

Smart contract failure: By interacting with the protocol, users expose themselves to the risk of smart contract failures / hacks. Despite dApps undergoing rigorous audits, there is always a chance of this in DeFi.

Oracle Risk: In addition to smart contract failures, there is the risk the oracles used by the protocol provide incorrect or stale data.

Not Self-Sovereign: By providing liquidity, users forfeit control of their assets and expose themselves to all the risks mentioned above. This is not unique to PactFi and is true with any DeFi dApp you lend, stake, farm, or provide liquidity on. When you take these actions, you forfeit your self-sovereign rights over your assets.

Always great! Thank you.

Great tutorial!