The Definitive Folks Finance Guide

You asked for it, so we created the definitive guide to upgrade your Folks game!

Folks Finance is a lending market that enables users to lend and borrow ALGO, stablecoins, ASAs, and Liquidity Pool (LP) tokens through a user-friendly UI. With the launch of V2 of the protocol in December 2022, Folks introduced new features such as high efficiency loans, collateral swaps, flash loans, stable rates, and multi-collateral/borrow loans.

Folks also designed and launched the first ALGO liquid staking Governance program (“Liquid Governance”). Governors who commit their ALGO to Governance through Folks “gALGO” – an asset pegged to the value of ALGO in a 1:1 ratio. gALGO can be deposited, leveraged as collateral, or taken off the platform to participate in other DeFi protocols.

Getting Started

Folks Finance’s “Dashboard” is your interactive hub to view all your deposits, collateral, and loans, and the main UI that you will use to deposit, borrow, withdraw, and create loans.

To get started, select the “Connect Wallet” button in the upper right hand corner:

Make use of your dashboard to streamline your actions across Folks.

How to Deposit & Withdraw Assets

You can deposit assets to Folks Finance’s market from the Dashboard. Assets lent to Folks Finance will accrue interest and can be used as collateral for borrowing.

To deposit an asset, select “Deposit” from the dashboard. On the next page, choose an asset from the “Available to Deposit” list and select “Deposit”.

Input the amount you want to supply, select “Deposit”, and finalize the transaction by signing it with your wallet:

If the asset you want to deposit isn’t in your wallet, you can use the “Swap and Deposit” feature on Folks. This feature enables you to swap out of an asset and deposit the new asset in one action.

Pretty cool, right gov?

To do this, choose the asset you want to supply and select “Swap and Deposit”:

Use the “Select asset” button to open up a menu of available assets to swap.

Select the asset you want to swap for the new asset, input the amount you want to swap, and select “Swap and Deposit”. Sign the transaction to complete the action.

Gov Tip: If you have an asset in your wallet, the deposit button will be blue. If you don’t it will be green.

Once you’ve deposited assets, you can keep track of them at the top of the Deposits tab:

To supply more assets or withdraw your position, select an asset from “Your Deposits”.

To supply more assets, select “Deposit” and use the “Deposit” or “Swap and Deposit” tabs, and follow the steps reviewed already.

To withdraw assets, select “Withdraw”, input the amount you want to withdraw, select “Withdraw”, and sign the transaction with your wallet.

How to Create & Manage Loans

To borrow assets on Folks, you need to create a loan first. There are three types of loans to choose from:

General loan type: A loan type that allows all available assets to be used. This provides the user with the flexibility to lend and borrow whatever assets they want but limits the loan-to-value (LTV) ratios and collateral factor to 80%.

Stablecoin efficiency type: A loan type that allows only stablecoins to be lent and borrowed. Although this loan type is more limited, taking a loan using a value-equivalent collateral type, like USDC/USDT, will enable you to borrow up to 90% LTV.

For example: in general loan types, USDC has a collateral factor of 80%, but with stablecoin efficiency loan types, USDC has a collateral factor of 90%. This is possible because the stablecoin efficiency loan type limits the different assets that can be borrowed, so the protocol can offer a higher LTV ratio without compromising safety.

ALGO efficiency type: A loan type that allows only ALGO and gALGO to be lent and borrowed. This loan type also enables you to borrow up to 90% LTV.

To create a loan, select “+ Create new loan” on the “Loans” tab. Name the loan, select the loan type, and select “Create loan” when you’re ready to finalize the action:

Once a loan has been created, you can add collateral by using assets you have deposited. To do this, select “Move to collateral” on your deposited assets within the “Your Deposits” section.

Use the drop-down on “Choose loan” to select the loan you want to add collateral to, input the amount you want to add to the loan and select “Move to collateral” when you’re ready to finalize the transaction with your wallet:

If you haven’t created a Loan yet, the “Move to collateral” option will prompt you to create a Loan:

Select “Create new Loan” and follow the steps outlined above.

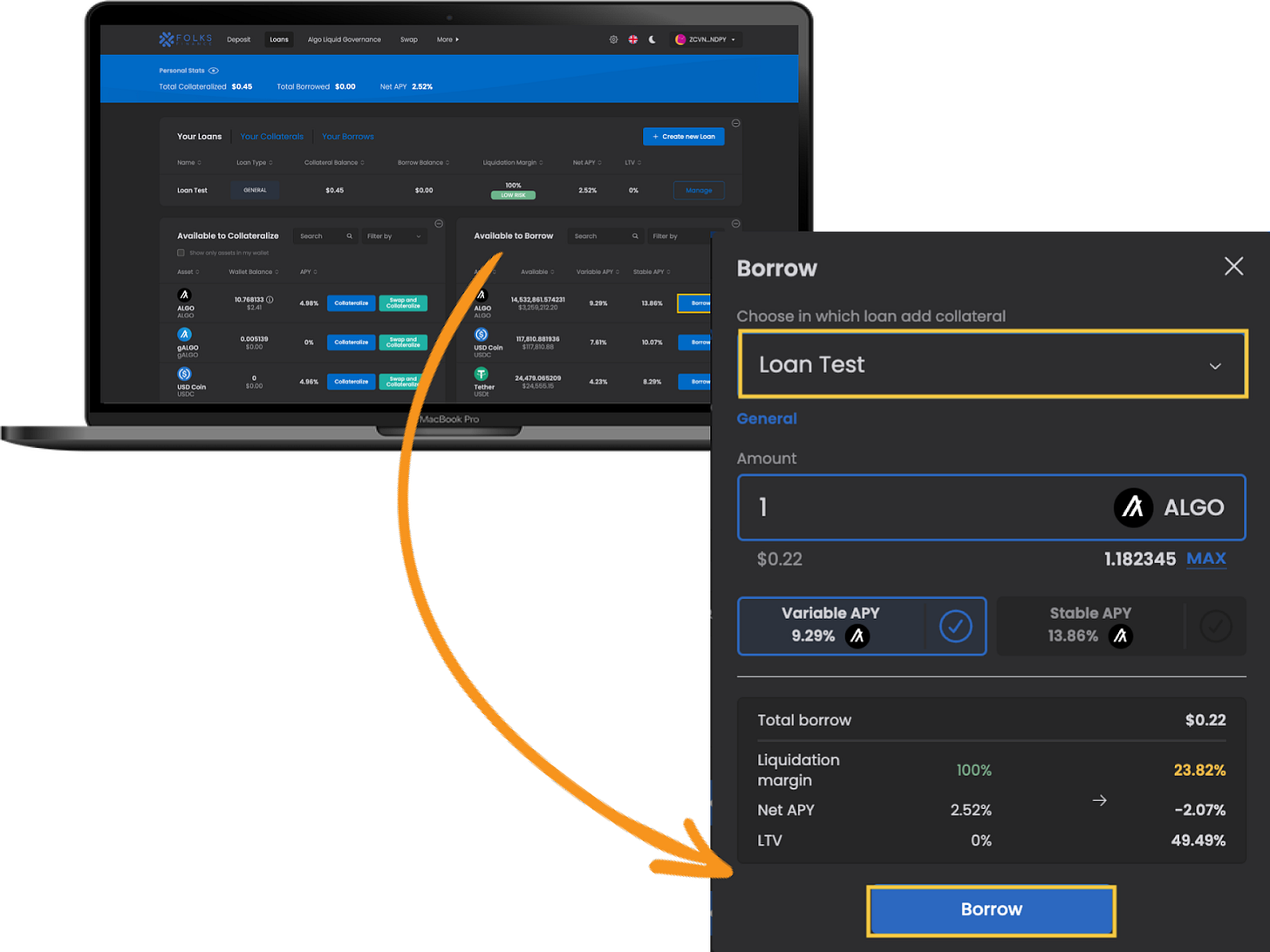

To borrow assets, choose one from the “Available to Borrow” section in the bottom right of the screen, and select “Borrow”:

Use the drop-down on “Choose loan” to select the loan you want to borrow against, input the amount you want to borrow, and choose the rate type. Select “Borrow” when you’re ready to finalize the transaction with your wallet.

Gov Tip: Variable rates fluctuate based on demand while stable rates are locked in until the end of the loan.

The “Your Borrows” section allows you to review your borrowing history, including the number of loans each asset is in and their respective APYs. Select “Borrow” on any asset to increase your position.

The “Your Loans” section provides information on each loan: loan type, collateral balance, borrow balance, liquidation risk, net APY, and LTV. Manage each loan by selecting “Manage” from the menu:

You can add, reduce, borrow, or swap collateral for your loan and repay it using the respective buttons on this page. The process of adding, reducing, and borrowing is similar to the processes already reviewed, but there are a few nuances to swapping and repaying that we’d like to cover.

Gov Tip: When you reduce your collateral without repaying your loan, you’ll increase your liquidation risk.

You can repay a loan three different ways: with the asset you borrowed, with another asset, or with collateral. To start this process, select “Repay” and choose between the three options:

Use the “Max” buttons under the “To” assets if you want to close out the position completely. The new “Repay with collateral” feature, enables you to scale out of positions more easily by reducing the number of actions needed to repay loans.

Pretty cool, right gov?

Folks Finance allows users to swap their collateral without closing out their position. This feature is great for stabilizing your position or locking in profits.

For example, if you’ve supplied ALGO as collateral while its price was $0.20, but the price begins to drop, you can swap your ALGO for USDC to avoid being liquidated.

Or on the other hand, if you’ve supplied ALGO as collateral at $0.20 and the price increases to $0.40, you can swap your ALGO for USDC to take profits.

To start this process, select “Swap” on the collateral you want to swap out of it. Choose the asset you want to swap into with the drop-down menu, input the amount you want to swap, and select “Swap” to finalize the transaction with your wallet:

To close out a loan entirely, you have to close out all borrows and withdraw your collateral. Since we’ve covered the former, let’s review how to do the latter.

To withdraw your collateral, select “Reduce” on all assets once you’ve paid back your borrows. Select “Max” and “Reduce collateral” from the pop-up to finalize the transaction with your wallet:

Once you’ve closed out all your positions, select the trashcan icon at the top of the loan details page and sign the transaction with your wallet to close out the loan:

Liquid Governance Guide

Liquid Governance is a liquid staking Governance program. Governors who commit their to Governance through Folks will receive an asset named “gALGO” – which is pegged to the value of ALGO – in a 1:1 ratio. gALGO can be deposited, leveraged as collateral, or taken off the platform to participate in other DeFi protocols.

Naturally, this feature serves a similar function to both Algofi’s Vault and the GARD Protocol; however, gALGO doesn’t require users to take a collateralized position against their Governance stake. Instead, they can begin earning instantly in the DeFi ecosystem with their gALGO directly or by swapping it for ALGO.

At the end of the Governance period, governors will burn their gALGO to redeem their committed ALGO and Governance rewards. Folks Finance will take a 5% fee from the rewards accrued for providing this service.

Gov Tip: Learn more about where you can use gALGO here.

How to Commit to Governance

To commit to Governance through Folks Finance, navigate to Liquid Governance and select “Commit” within the “Your Wallet” section to begin:

Input the amount of ALGO you want to commit to Governance, opt-in to gALGO, select “Commit”, and sign the transaction with your wallet to finalize the process.

You can also use the “Swap and Commit” feature to commit alternative assets to gALGO by selecting “Swap and Commit”:

Use the drop-down menu to select the asset you want to swap into gALGO, input the amount, select “Swap and commit”, and finalize the transaction by signing it with your wallet.

Gov Tip: You won’t receive your gALGO – no matter which option you choose – until the redemption phase of the previous period is over. You can pre-mint gALGO and the gALGO will be transferred to your wallet once the redemption period is over.

Once you’ve minted your gALGO, you can view your gALGO balance, total ALGO committed, and your estimated rewards from the dashboard:

Gov Tip: You can vote on both Algorand and Folks Finance Governance measures within the “Voting” section once both are live.

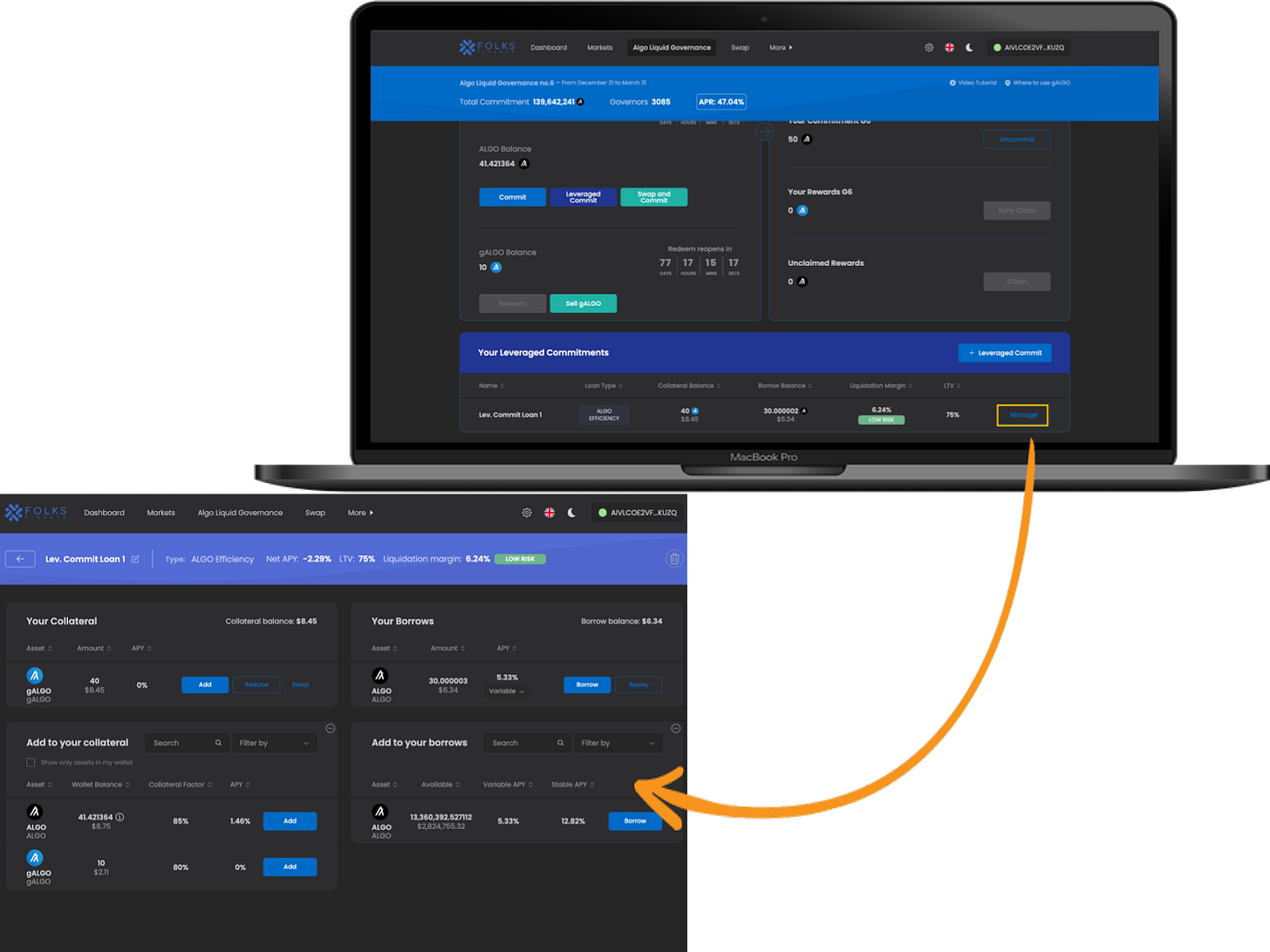

You can also use the “Leveraged Commit” option to execute a looping strategy with one click. To execute a looping strategy, you would need to:

Commit ALGO & mint gALGO

Use gALGO as collateral

Borrow ALGO against your position

Repeat steps

The “Leverage Commit” option does this automatically on the backend for you up to four times.

To commit to Governance on Folks with leverage, select “Leveraged Commit”, input the amount you want to commit to Governance, and choose your multiplier and rate.

Select “Commit” and sign the transaction with your wallet to finalize it:

Gov Tip: Leveraged Commit puts you at risk of liquidation and it’s not recommended until you understand its mechanics. Additionally, as more users make use of this option, the variable APY can skyrocket leaving you in a position where your Governance position is unprofitable.

Opening a leveraged Governance position opens up a loan on Folks Finance. Select “Manage” to add and remove collateral from your position:

To uncommit from Governance, select “Uncommit” from the “Your Commitment” section on the right hand:

Input the amount you want to uncommit, select “Uncommit”, and finalize the transaction by signing it with your wallet.

How to Claim Rewards

To claim your rewards after the period ends, select “Claim” in the bottom right of the screen:

Folks Finance also allows users to claim rewards before the period is over. To do this, select Early Claim” and sign the transaction with your wallet:

How to Redeem gALGO

You must redeem your gALGO at the end of each Governance period to receive your ALGO back.

To redeem your gALGO, select “Redeem”, input the amount you want to redeem, select “Redeem”, and sign the transaction with your wallet:

You can recommit your ALGO to Liquid Governance immediately by checking the box next to “Commit”. Your redeemed ALGO will be automatically committed for the next period; however, the gALGO won’t be transferred to your wallet until the redemption period has ended.

Markets Overview

You can review the stats for assets from the Dashboard of Folks Finance. Use this screen to better understand the total amount deposited and borrowed of each asset and the APRs for both depositing and borrowing.

How to Swap

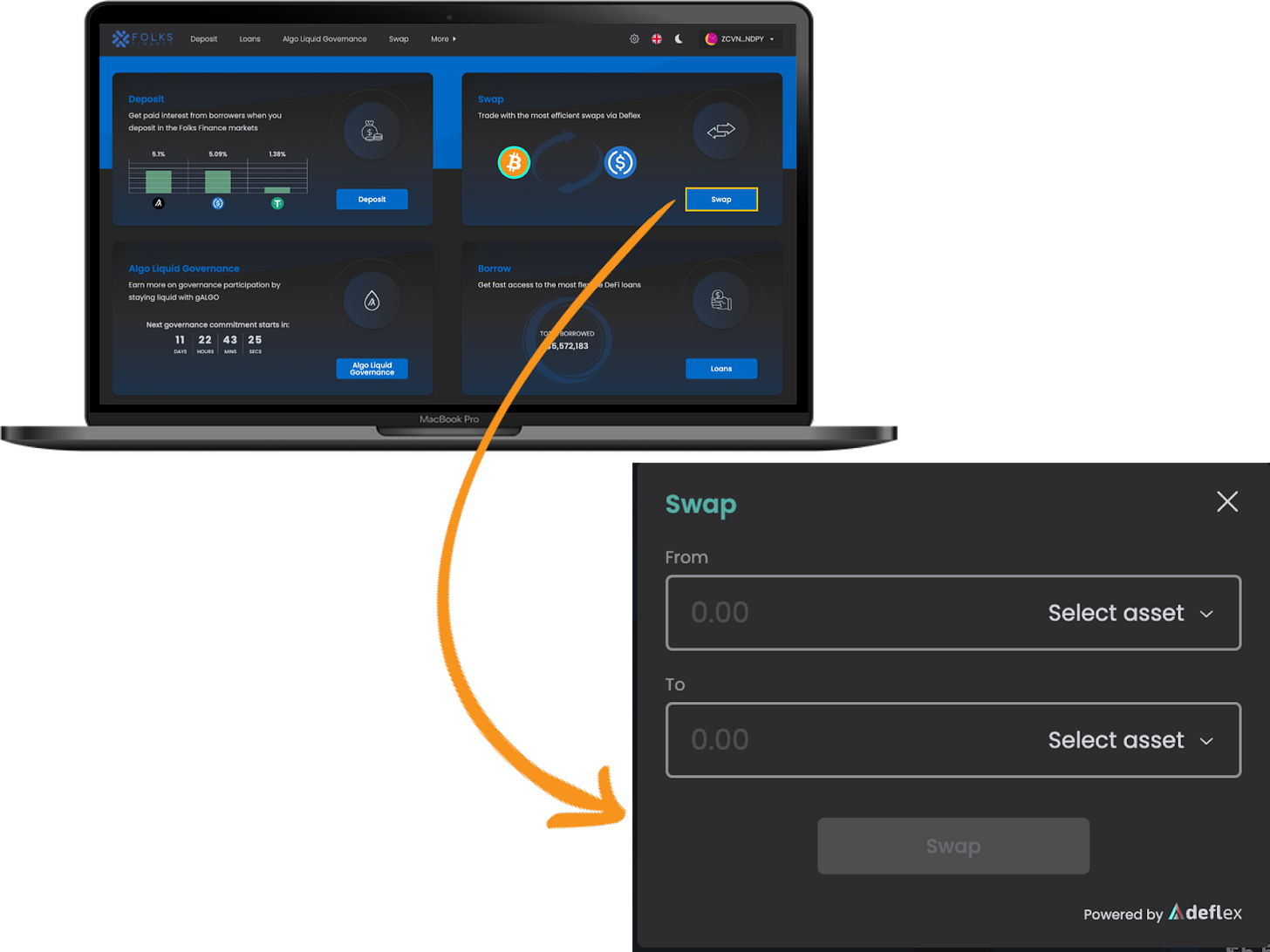

You can swap assets directly on Folks by using the “Swap” button from the menu:

Alternatively, you can select “Swap” from the Dashboard screen:

Use the “Select Asset” buttons to set up your swap and then select “Swap” when you’re ready to finalize the transaction with your wallet.

Gov Tip: Folks Finance’s “Swap” is powered by Deflex, an Algorand-wide exchange protocol that aggregates the liquidity across DEXs. Check out Deflex’s official docs to learn more.

Miscellaneous

To personalize your default currency and node settings, select the gear icon in the upper right of the screen

To switch between light and dark modes, use the sun and moon icons at the top

Change your default language by selecting the flag icon

Select the “More” tab to view Folks Finance’s official docs, social channels, and testnet

And that’s it, gov! You’re now a Folks Finance pro.

If you want more information on how to use the protocol, we recommend you start with their official docs.

Disclaimer: This isn’t financial advice! As we say in crypto, don’t trust – VERIFY! Do your own research to determine if Folks Finance is right for you and don’t ever invest more than you’re willing to lose.

Like any DeFi project, Folks Finance comes with risks:

Borrow Rate Increases: The Borrow APR for ALGO could increase to the point that it is higher than the Governance APR. This has the potential to make the use of the Liquid Governance unprofitable depending on the strategy users take (i.e. DeFi Beginner strategy above).

Liquidation: If users borrow assets other than ALGO against their gALGOs, they introduce the risk of being liquidated. You can learn more about Folks Finance’s liquidation methodology here.

Smart contract failure: By interacting with the protocol, users expose themselves to the risk of smart contract failures/hacks. Despite dApps undergoing rigorous audits, there is always a chance of this in DeFi.

Oracle Risk: In addition to smart contract failures, there is the risk the oracles used by the protocol provide incorrect or stale data.

Not Self-Sovereign: By committing ALGOs to Governance through Liquid Governance, users forfeit the self-sovereignty of their ALGOs. Users forfeit the right to vote, avoid liquidation and regain control over their ALGOs without having to pay the protocol off first (if a loan is taken).

Gov Tip: This is not unique to Folks Finance and is true with any DeFi dApp you lend, stake, farm, or provide liquidity on. When you take these actions, you forfeit your self-sovereign rights over your assets.